Balancing the Budget: Why deflating the carbon bubble requires oil & gas companies to shrink

To deflate the carbon bubble and protect investors, oil & gas companies must shrink

Sign up today to download

the full report

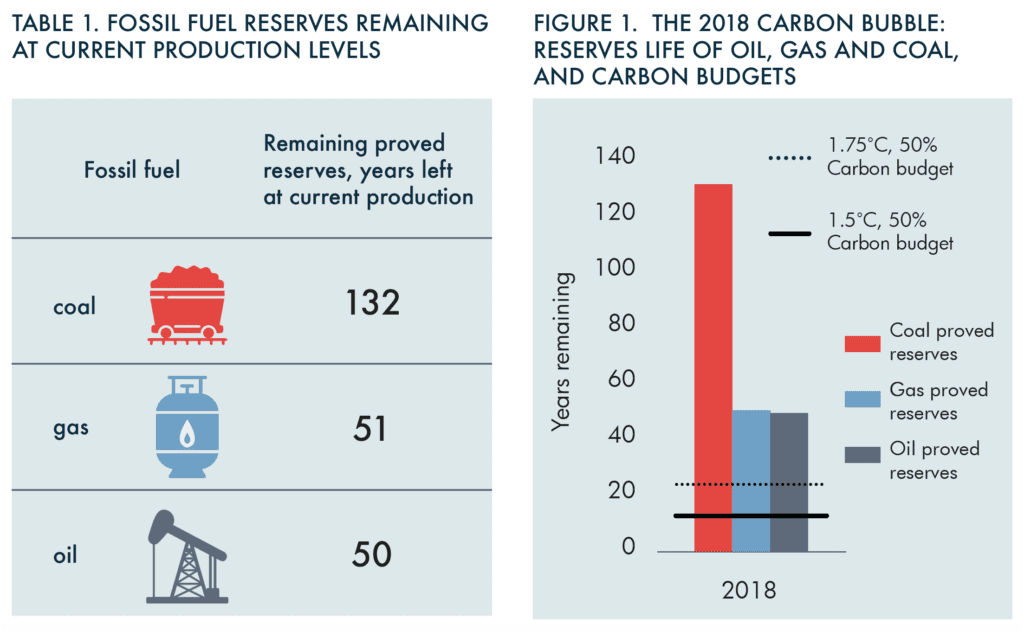

The current requirements under the Paris Agreement are that nations limit warming to “well below” 2ºC and “pursue efforts” for 1.5ºC. For a 50% chance of success, carbon budgets for 1.5ºC and 1.75ºC, irrespective of the trajectory taken, equate to 13 and 24 years at current CO2 emissions levels.

Source: IPCC, Global Carbon Project, BP, CTI analysis

Company Carbon Budgets

Source: IPCC, Global Carbon Project, BP, CTI analysis

Company Carbon Budgets

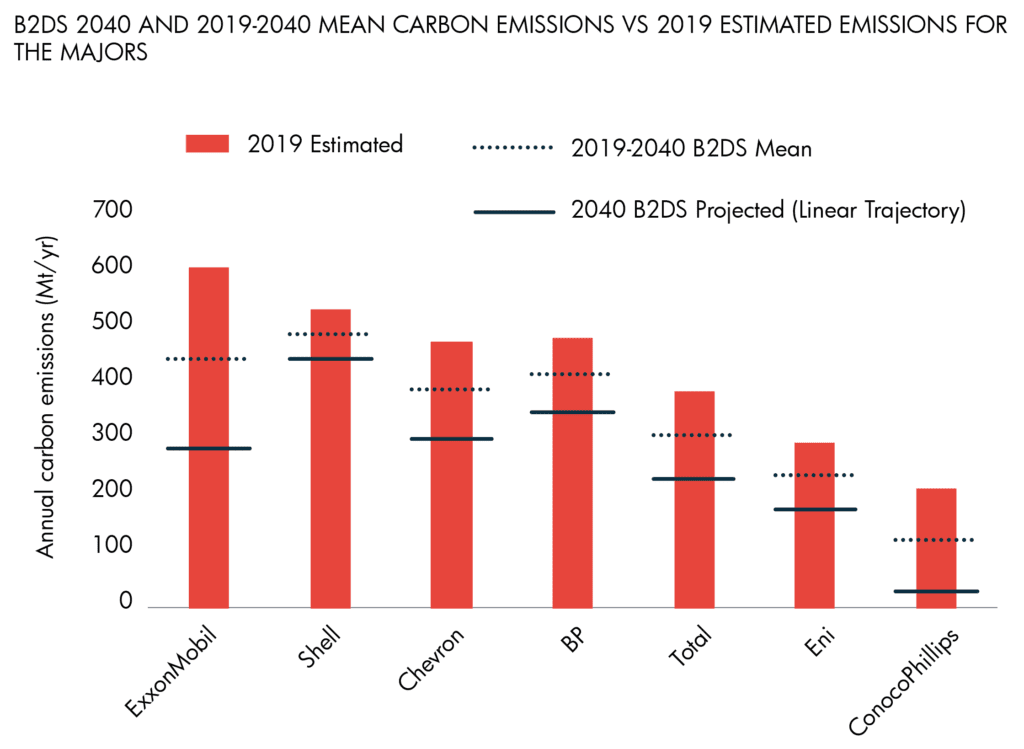

We translate the macro global carbon budget to the company level and define “company carbon budgets” to provide aggregate limits for individual oil and gas producers.

Source: Rystad Energy, IEA, CTI analysis

Source: Rystad Energy, IEA, CTI analysis

The majors need to significantly reduce emissions from oil and gas production over the next two decades by on average 40% by 2040 compared to 2019 levels.

Based on our analysis, ExxonMobil and ConocoPhillips are modelled as having to reduce emissions at the fastest rate to stay within their respective company carbon budgets. Shell's portfolio is most aligned, but would still need cuts of 10%

Quotes

Mike Coffin, Oil & Gas Analyst at Carbon Tracker and report author, said: “If companies and governments attempt to develop all their oil and gas reserves, either the world will miss its climate targets or assets will become “stranded” in the energy transition, or both. The industry is trying to have its cake and eat it -- reassuring shareholders and appearing supportive of Paris, while still producing more fossil fuels. This analysis shows that if companies really want to both mitigate financial risk and be part of the climate solution, they must shrink production.”

Andrew Grant, Senior Oil and Gas Analyst and co-author of the report said: “Only Shell, Total and Repsol have targets which include the “Scope 3” emissions created by burning their products, which account for the vast majority of CO2 related to fossil fuel use. While an improvement on many peers, they have only pledged to reduce the carbon intensity of the energy they produce, which means they can continue to grow fossil fuel production -- increasing CO2 emissions overall and leaving open the risk of stranded assets. Our climate system works on finite limits, so strategies that allow infinite growth are a square peg in a round hole.”

Mark Fulton, Chair of Carbon Tracker’s Research Council, said: “Our Breaking the Habit work shows the amount of capex consistent with achieving “well below” 2˚C. Based on the same project level analysis we can express this in terms of a carbon budget with associated production levels. This therefore gives a comprehensive picture with consistent metrics that can be factored into company planning.“

Mark Campanale, Founder and Executive Director, said: “In our first 2011 report, Unburnable Carbon: Are the world’s financial markets carrying a Carbon Bubble? we highlighted the finite global carbon budget and the risks from excess supply of fossil fuels. Carbon Tracker has been consistent in finding most fossil fuels must remain in the ground. “Yet as this new report highlights, companies and the governments that grant them their licences are still intent on expansion. It is now more urgent than ever that shareholders promote, then support, plans for the oil and gas sector to manage rapid decline in production.”