Carbon Countdown: Prices and Politics in the EU-ETS

Sign up today to download

the full report

Market counts down to the MSR

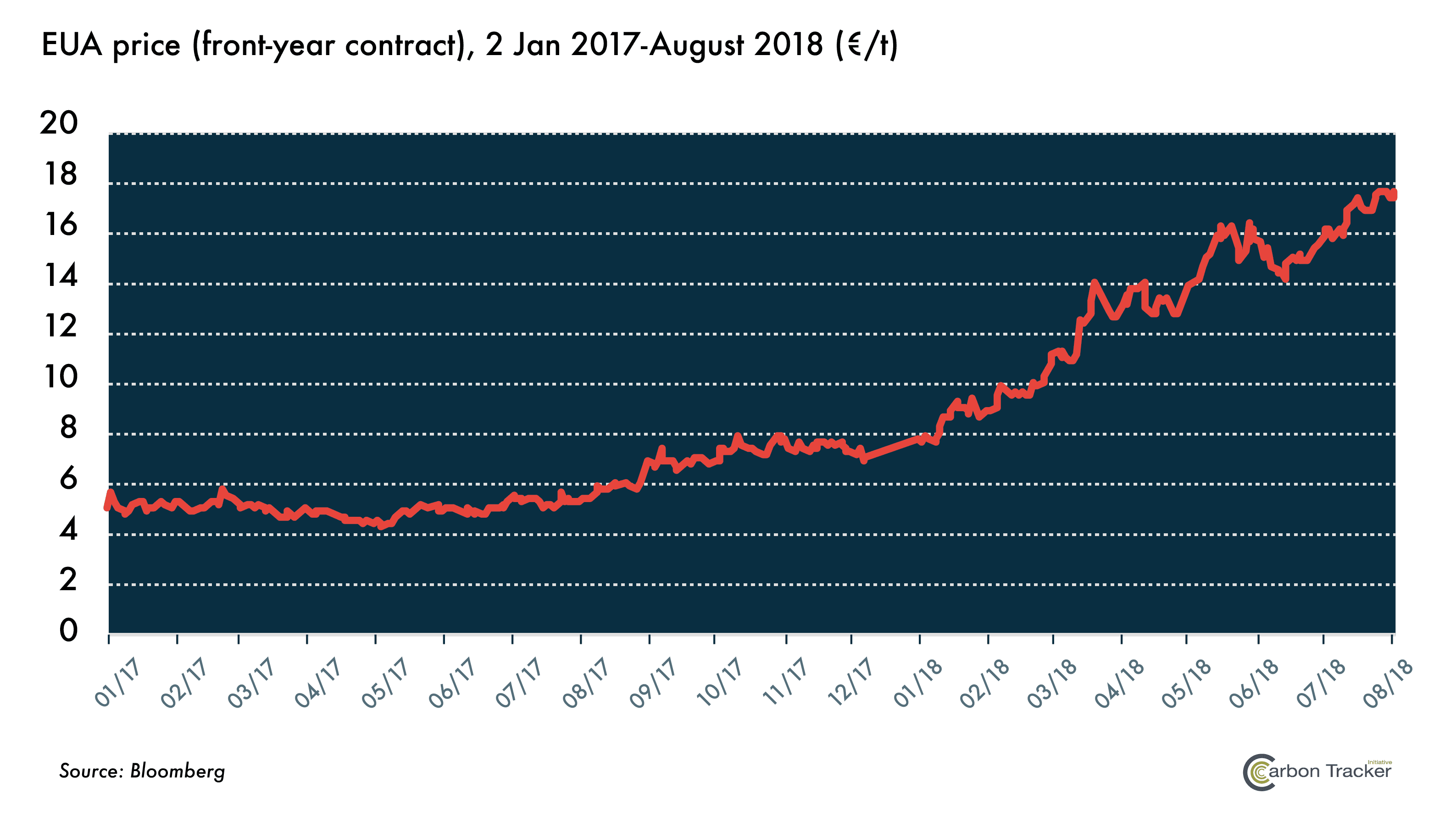

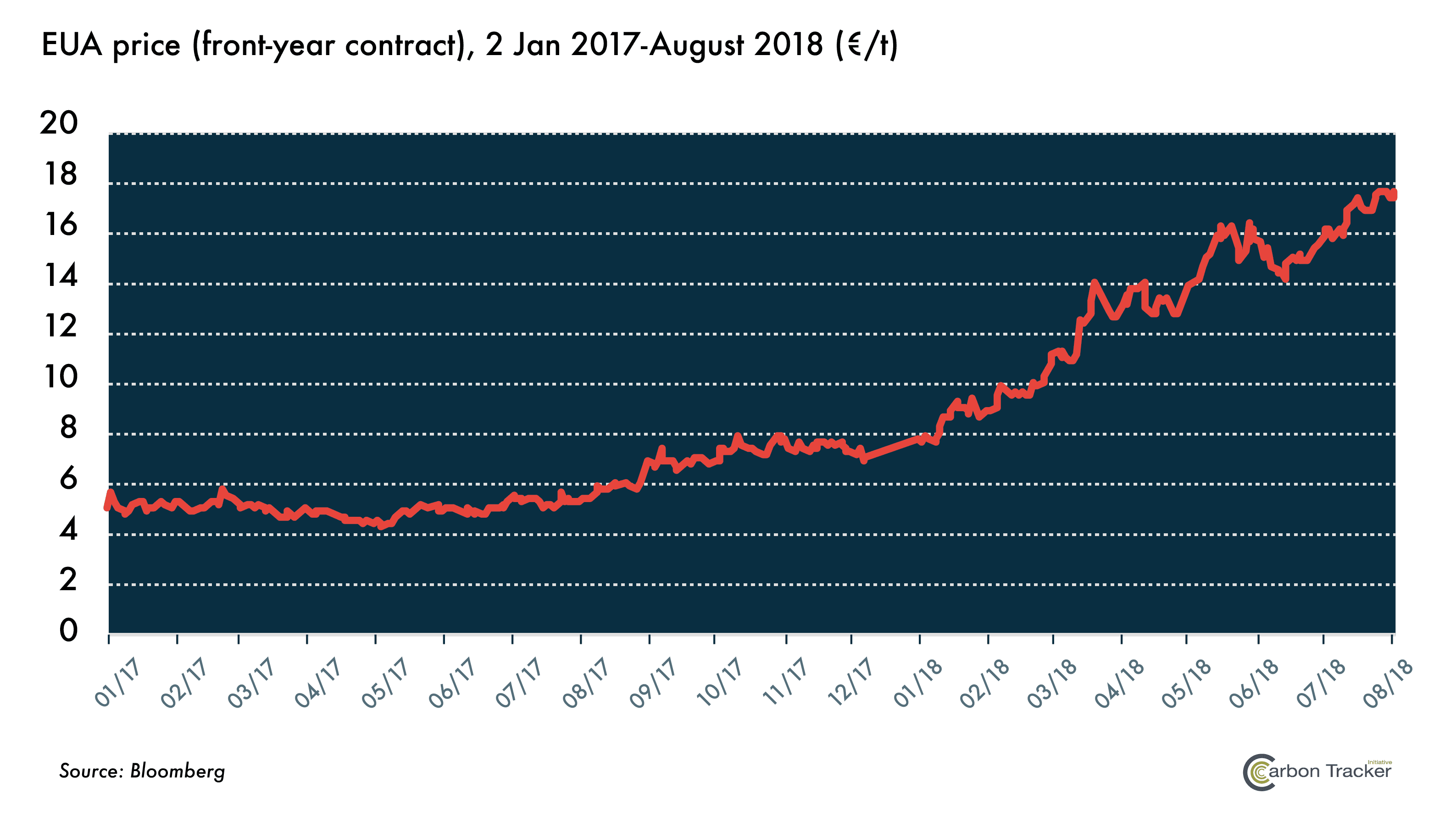

The EU carbon market has been the hottest commodity market in the world over the last 16 months, with the price of European carbon allowances (EUAs) up 310% since May 2017, 120% since the start of the year, and 33% since we published our Carbon Clampdown report in April (Figure 1).

This stunning performance has been driven by the market’s anticipation of the start-up from January 2019 of the Market Stability Reserve (MSR), the centrepiece of the EU-ETS reform agreed last year. With only five months to go before the MSR starts reducing the over-supply of EUAs by 24% of the outstanding cumulative surplus each year over 2019-2023, the market is now counting down to the biggest supply squeeze the EU-ETS has ever seen.

In this report we have updated our analysis of the EU-ETS in several ways (see section 1 for full details). We begin our analysis with the same pre-abatement approach to modelling that we used in our previous report, Carbon Clampdown, but we then go one step further by attempting explicitly to model the amount of emissions reductions that can occur from fuel switching and energy-efficiency savings over 2019-23 if EUA prices rise to levels that flip the merit order and enable gas to run ahead of coal across the EU.

In this report we have updated our analysis of the EU-ETS in several ways (see section 1 for full details). We begin our analysis with the same pre-abatement approach to modelling that we used in our previous report, Carbon Clampdown, but we then go one step further by attempting explicitly to model the amount of emissions reductions that can occur from fuel switching and energy-efficiency savings over 2019-23 if EUA prices rise to levels that flip the merit order and enable gas to run ahead of coal across the EU.

Figure 1: EUA price (front-year contract), 2 Jan 2017-August 2018 (€/t)

In this report we have updated our analysis of the EU-ETS in several ways (see section 1 for full details). We begin our analysis with the same pre-abatement approach to modelling that we used in our previous report, Carbon Clampdown, but we then go one step further by attempting explicitly to model the amount of emissions reductions that can occur from fuel switching and energy-efficiency savings over 2019-23 if EUA prices rise to levels that flip the merit order and enable gas to run ahead of coal across the EU.

In this report we have updated our analysis of the EU-ETS in several ways (see section 1 for full details). We begin our analysis with the same pre-abatement approach to modelling that we used in our previous report, Carbon Clampdown, but we then go one step further by attempting explicitly to model the amount of emissions reductions that can occur from fuel switching and energy-efficiency savings over 2019-23 if EUA prices rise to levels that flip the merit order and enable gas to run ahead of coal across the EU.

The logic of our argument is that the supply squeeze caused by the MSR over 2019-23 will create a cumulative deficit for the power and aviation sectors over these five years of ~ 1.4bn tonnes, and that in order to clear the market over this period power generators will have to reduce emissions via switching from coal to gas.

We conclude that in order to achieve the level of fuel-switching required to clear the market over 2019-23 it will be necessary for combined-cycle gas-turbine plants (CCGTs) with a thermal efficiency rate of 45% and above to displace coal plants with thermal efficiencies of 38% and below. With the fuel-switching price very sensitive to efficiency rates, then other things being equal this implies higher EUA prices than we imputed from our modelling in our previous report, Carbon Clampdown.

Pricing caveat

There are many dynamic variables in play when we consider how EUA prices might evolve over 2019- 23, and we would therefore emphasize that our revised indicative pricing range for EUAs comes with a number of caveats. In particular, depending on(i) exactly how much abatement might be required over 2019-23, (ii) the amount and availability of CCGTs with the required efficiency levels, and (iii) the evolution of commodity prices between now and 2021, the EUA price required to plug generators’ and airlines’ forward-hedging gap could be higher or lower than the levels imputed from our modelling.