Managing Peak Oil: Why rising oil prices could create a stranded asset trap as the energy transition accelerates

Sign up today to download

the full report

Figure 1 – High investment case severely oversupplies market in period 2 (2027-2040)

Oil supply from already-sanctioned (post-FID) projects and new projects sanctioned in period 1 (2022-2026) in the high investment (left chart) and managed (right chart) cases, with FPS oil demand

Source: Carbon Tracker analysis

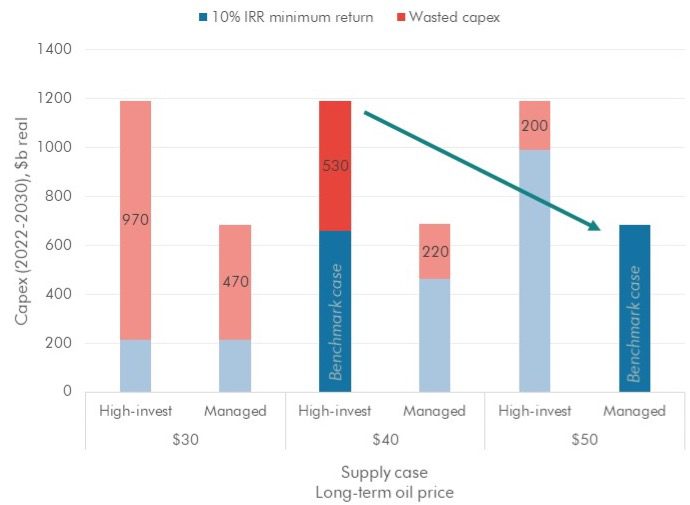

Figure 2 – Managed case could eliminate value destruction

Capex (2022-2030) on projects approved in 2022-2026 split by commerciality at two supply cases and three long-run oil prices

Source: Carbon Tracker analysis

This analysis updates our previous IPR research, Handbrake Turn.- Oil demand and pricing are currently rebounding, triggering calls for significantly increased investment into new oil – a narrative at odds with the immediate global production reductions required within most “well below 2°C” scenarios.

- Short-term demand growth would see even greater reductions required subsequently to keep the goals of the Paris Agreement alive. Policy action is likely to strengthen post-COP26, while the rapid adoption of EVs will potentially further weaken demand.

- Companies basing sanctioning decisions on bullish short-term signals thus risk significant over-investment, seriously impacting shareholder value. It wouldn’t be the first time that the industry has fallen into this trap.

- This analysis therefore explores the financial implications of such a non-linear scenario, where oil demand grows in the short-term before falling rapidly. We use the Inevitable Policy Response Forecast Policies Scenario (FPS, 1.8°C) where oil demand peaks in the mid-2020s.

- Under a ‘high-investment case’, companies could waste some $530bn of capex this decade as demand starts to decline and the oil price falls back to c.$40. This amount would double at $30/bbl.

- As an alternative, we explore a ‘managed’ case where companies sanction more conservatively for long-cycle projects, only up to $30/bbl breakeven. The managed case then assumes companies sanction more liberally for short-cycle projects (which ramp up production quickly), up to $50/bbl breakeven, to meet elevated short-term demand.

- The key is to avoid locking in high-cost, long-cycle projects. Our managed case significantly cuts oversupply over the long term and eliminates wasted capex at a $50/bbl long-run oil price. The managed case wastes less capital than the high investment case irrespective of oil price.

- Managing oil prices in the next few years would be a challenge under a scenario such as the FPS, even allowing for increased shale production. There is, however, enough oil to meet the short term bump.

- OPEC needs to deploy its spare capacity much more aggressively to avoid even higher prices than today – up to an extra 2mbd in the managed case. This is what can stop the oil price spiking beyond $80; without this, higher prices could last for several years. We believe this is in the group’s long-term interests.

- For investors who subscribe to an FPS-like pathway, it’s imperative to challenge management on higher cost projects, particularly those with sanction some years hence.

Quotes

Axel Dalman, Oil & Gas analyst and lead author of the report said: “Companies may see high prices as a huge neon sign pointing towards investment in more supply. However, this could become a nightmare scenario if they go ahead with projects which deliver oil around the time that demand stars to decline. Shareholders could face catastrophic levels of value destruction as prices fall.”

Mark Fulton, Chair of Carbon Tracker’s Research Council and a co-author, said: “A sustained surge in the oil price is not necessary as the industry can both meet peak demand and manage its way through that without wasting capital by applying discipline”.

Mike Coffin, head of oil & gas and also a co-author said: “We know demand will weaken as the policy response to the climate crisis and deployment of new technologies accelerates. For companies to effectively manage this transition, they must resist the temptation to invest heavily on short-term price signals. Failure to acknowledge the sea change risks wasting huge amounts of capital, delivering sub-par returns to investors, and locking-in emissions that take the world beyond Paris goals.”