No country for coal gen – Below 2°C and regulatory risk for US coal power owners

Sign up today to download

the full report

Coal’s market share in the US power mix is being diminished at an unprecedented rate due to fierce competition from cheap gas and renewables.

Around 30 GW of coal capacity has been retired over the last three years, with coal generation declining by 13% over the same period. The economics of US coal power could not be starker: new coal capacity is not remotely competitive, while in the next few years it will be the exception rather than the rule for the operating cost of existing coal to be lower than the levelized cost of new gas and renewables.

The purpose of this report is threefold:

- provide a tool for investors who have exposure to US coal power to make their portfolio compliant with the Paris Agreement in an economically rational way;

- detail how an outdated regulatory framework is one of the only reasons why uncompetitive coal power continues to operate in the US; and

- highlight how phasing-out coal power could save US citizens money and make the US economy more competitive.

Our modelling approach

Our net present value (NPV) model values units based on their regulatory status. Regulated units are valued based on the revenue requirement approved by regulators, while merchant units are valued based on their cost relative to a new combined cycle gas turbine (CCGT). Our NPV model values every operating unit in the US to generate two separate scenarios:- Below 2°C scenario for all units. Stranded value under the below 2°C scenario is defined as the difference between the IEA “Beyond 2°C Scenario” (B2DS) – which phasesout all unabated coal power by 2035 – and business as usual (BaU) based on company reporting. A 2°C Scenario (2DS) is also included for comparison. Every existing coal unit (both regulated and merchant) is forecasted and ranked to develop a retirement schedule based on its operating cost and system value. The impact on unit valuation from the retirement schedule is aggregated up to the listed coal owner, to provide a tool for investors to comply with the Paris Agreement in way that is economically rational.

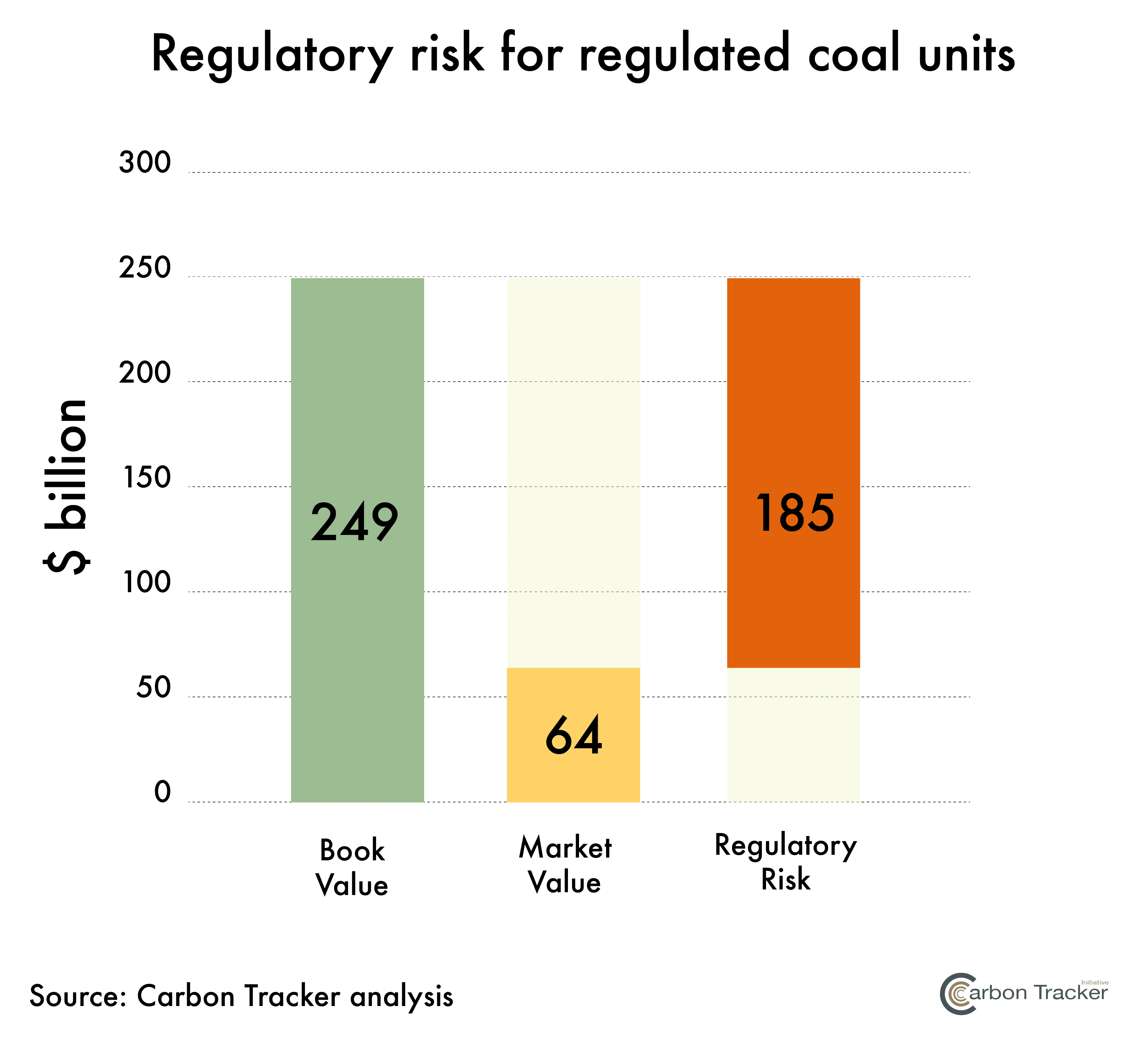

- Regulatory risk scenario for regulated units. Regulatory risk under this scenario is defined as the difference between regulatory and market valuation of all regulated units. Regulated units are valued based on the revenue requirement approved by regulators, while market valuation assumes the unit has no value if the operating cost is greater than the cost of a new CCGT. The impact on unit valuation from comparing assets with the most competitive dispatchable power technologies is aggregated to highlight the extent uncompetitive coal power is being subsidized by an out of date regulatory framework.

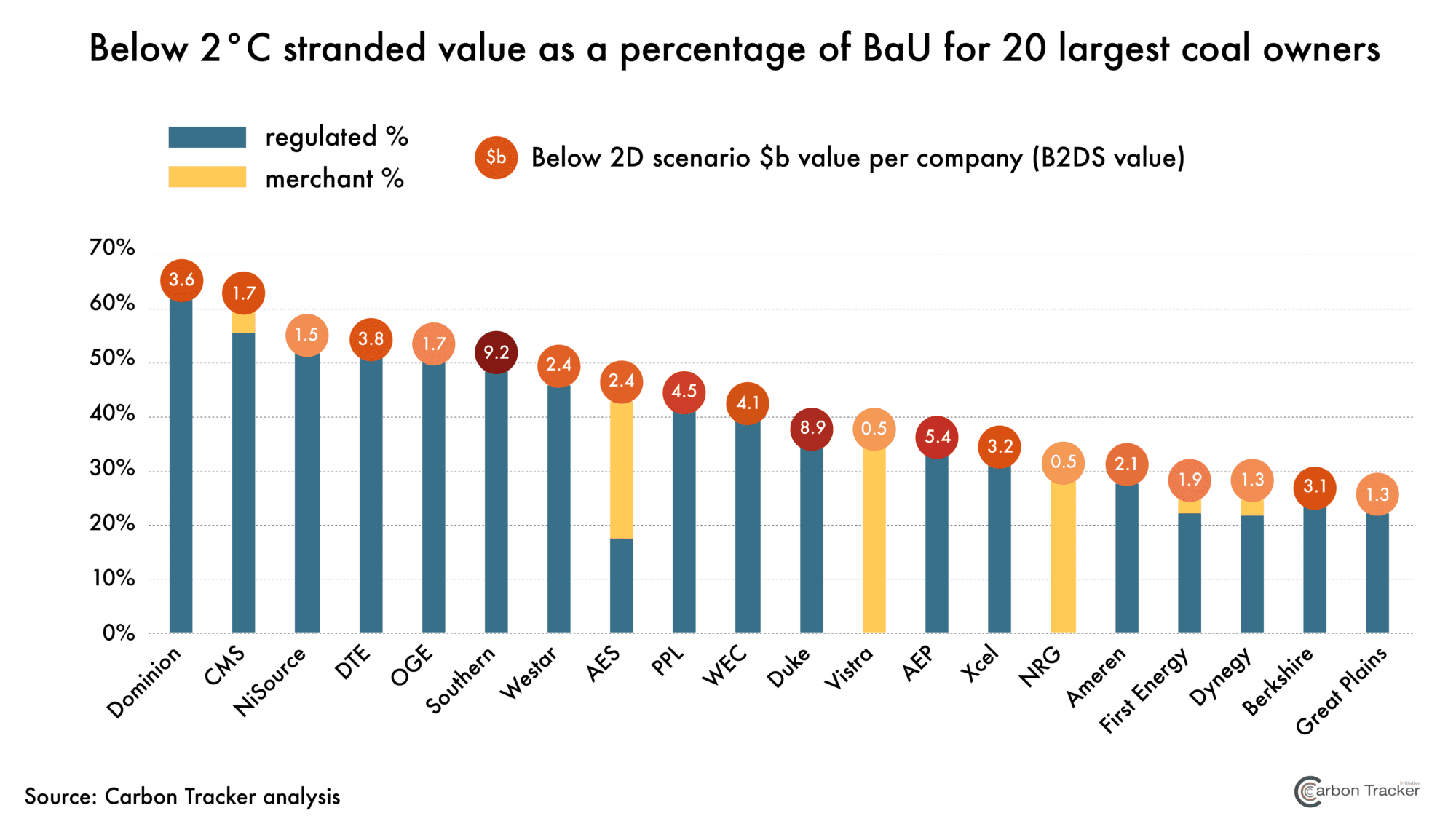

Below 2°C scenario – $104 billion of stranded value for all listed coal owners

We estimate the total stranded value for coal owners in the B2DS for the period to 2035 to be $104 billion. Out of the 20 largest listed coal owners, Dominion has the highest proportion of value at risk under a B2DS scenario with more than 60% of stranded value compared to the BaU scenario. CMS, NiSource and DTE are also at risk with 59%, 52% and 51% of stranded value against the BaU scenario, respectively. Stranded value as a percentage of the BaU scenario is dependent on the regulatory status and operating For example, Dominion’s units are both high cost and regulated. The materiality of stranded value is contingent on exposure relative to total assets. For instance, Berkshire Hathaway owns a substantial amount of regulated coal capacity, but the stranded value from these units is dwarfed by their market capitalisation resulting from its diversification across many sectors of the economy.

For example, Dominion’s units are both high cost and regulated. The materiality of stranded value is contingent on exposure relative to total assets. For instance, Berkshire Hathaway owns a substantial amount of regulated coal capacity, but the stranded value from these units is dwarfed by their market capitalisation resulting from its diversification across many sectors of the economy.

Regulatory risk scenario – $185 billion of regulatory risk for all regulated units

We estimate $185 billion of regulatory risk for all regulated units projected out to 2035. Regulated utilities are mostly protected from competition, charging government-approved prices and receiving guaranteed returns. Merchant utilities are competitive businesses that operate in wholesale power markets. Merchants know first-hand the implications of owning coal capacity: over the past two years listed merchants have lost around half of their market capitalisation. This is in part due to operating high-cost coal units. Despite also holding highcost coal units, owners of regulated coal units pass on this cost to ratepayers and, as such, have not suffered the same financial consequences. Yet, as cheap gas and renewables expand throughout the country, the cost impact of coal for ratepayers will become harder to ignore. The difference between book and market value represents the regulatory risk for regulated utilities who – by continuing to operate high cost coal units – are putting their financial interests ahead of the consumers they serve.

Energy transition versus corporate welfare – phasing out unprofitable coal could save $10 billion per year and reduce household electricity bills by up to 10% by 2021

Utilities that own regulated units often have little incentive to retire costly coal power. While merchant units are subject to financial losses through market forces, regulated units pass costs onto customers. The rate base creates a perverse incentive as utilities with regulated capacity are often motivated to continue investing in existing coal units. As mentioned above, an overwhelming proportion of existing coal capacity will soon be economically unviable compared to other new and existing power technologies. However, these coal units could be kept running as owners seek to make ongoing capital investments to earn a return on the remaining undepreciated balances. This form of corporate welfare is stifling the energy transition at the expense of consumers. Phasing-out coal could save the US consumer $10 billion per year by 2021, with Kentucky, Indiana and Michigan households saving on average 10%, 9% and 7%, respectively on their electricity bills. This reality contrasts with recent rhetoric from the Trump Administration about the virtues of continuing to rely on coal power.Recommendations

Regardless of federal politics, the transition in the US power sector has reached escape velocity: end-user efficiency and onsite generation are crimping load growth, while renewable energy and electric vehicles are going to change power systems in ways previously unimaginable. A below 2˚C pathway would save US power consumers money – and therefore make the US economy more competitive – but this reality will only be realised if regulation catches up with the structural changes that have occurred over the last three years. Our recommendations outline how:- investors can make their US power investments compliant with the Paris Agreement;

- energy transition obstruction could have a negative impact on regulated coal power; and

- regulators can be harbingers of change.