Responding to Shell: An Analytical perspective

Sign up today to download

the full report

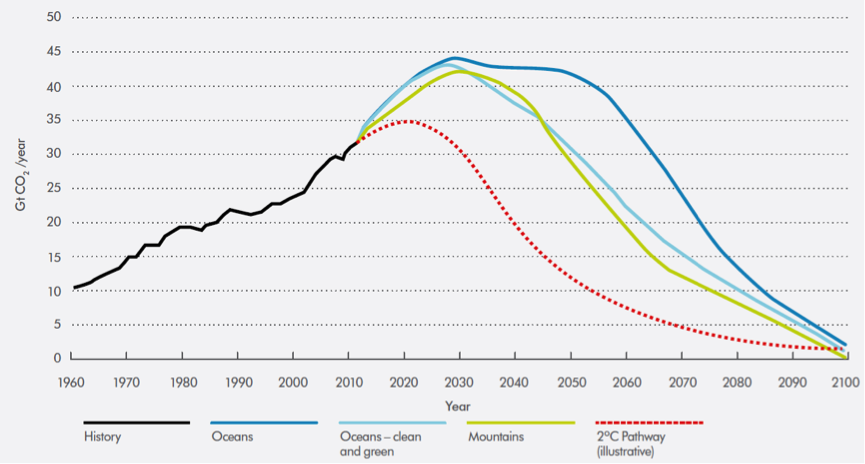

Global energy-related CO2 emissions in Shell New Lens scenarios – close to a 6°C pathway

We believe that among the weakest claims in Shell’s letter is that the world will require through 2100 to "tackle and resolve" the climate issue. Waiting this long, however, will probably mean the world has failed to address climate change adequately. Stabilizing and then reducing atmospheric concentrations of CO2 emissions is indeed a long-term challenge, but the results of Shell’s scenarios yield no definitive conclusions about the timeframe over which the challenge can be met.

We believe that among the weakest claims in Shell’s letter is that the world will require through 2100 to "tackle and resolve" the climate issue. Waiting this long, however, will probably mean the world has failed to address climate change adequately. Stabilizing and then reducing atmospheric concentrations of CO2 emissions is indeed a long-term challenge, but the results of Shell’s scenarios yield no definitive conclusions about the timeframe over which the challenge can be met.

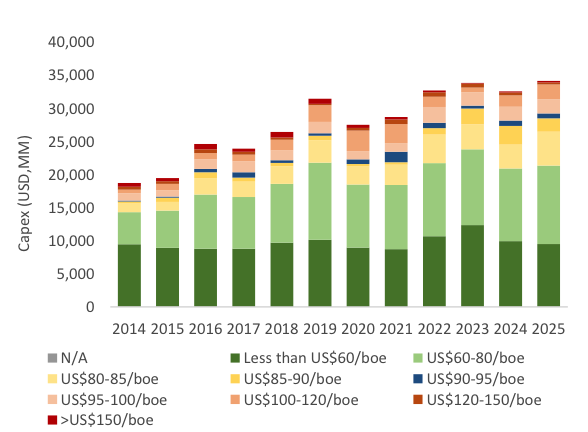

Shell potential upstream oil capex broken down by BEOP level, 2014-2025 ($MM)

Of Shell's $334 billion in potential (“potential” again includes capital spend on the prospective resources that Shell could develop) upstream oil capex from 2014-2025, $107 billion (32%) is projected to be spent on projects with a BEOP above $80/bbl. As described in our report "Carbon Supply Cost Curves: Evaluating Financial Risk to Oil Capital Expenditures", such break-even price can be considered the maximum threshold up to which oil projects become high-risk and high-cost.

Of Shell's $334 billion in potential (“potential” again includes capital spend on the prospective resources that Shell could develop) upstream oil capex from 2014-2025, $107 billion (32%) is projected to be spent on projects with a BEOP above $80/bbl. As described in our report "Carbon Supply Cost Curves: Evaluating Financial Risk to Oil Capital Expenditures", such break-even price can be considered the maximum threshold up to which oil projects become high-risk and high-cost.

Media

The Economist, 19th July 2014 Shell, Exxon and carbon The elephant in the atmosphere ‘Exxon Mobil and Shell are the most recent to get back with their assessment of the risk: zero. “We do not believe that any of our proven reserves will become ‘stranded’,” says Shell. CTI have recently release a thorough response to Shell’s letter on stranded asset and carbon bubble and will soon issue a similar response to Exxon.’ Read the article. Download the Press Release here.Quotes

Anthony Hobley, CEO of CTI: "With this combative stance, Shell has missed an opportunity to explain to its shareholders how its capital expenditure plans are resilient to the impending energy transition. Acknowledging the seriousness of the climate challenge whilst at the same time asserting no effective action will be taken until the end of the century is as classic a case of Orwellian double think as you are likely to find."

Mark Fulton, ETA Founding Partner and Advisor to CTI: "We believe that by stress testing more aggressively Shell’s future assumptions about demand and climate policy that this will lead to a productive dialogue with investors on capital management and capital discipline in relation to high-price high-carbon investments."