The Great Coal Cap: China’s energy policies and the financial implications for thermal coal

Sign up today to download

the full report

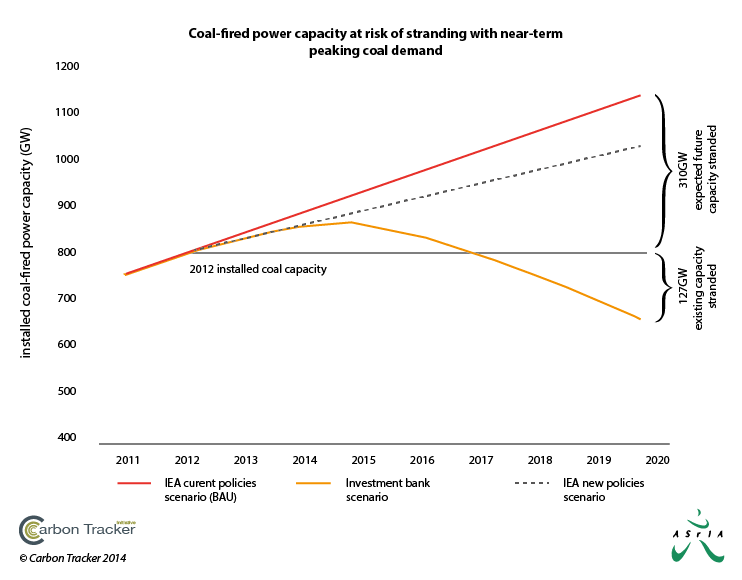

- What are the drivers leading many to predict the near-team peaking of China’s thermal coal demand?

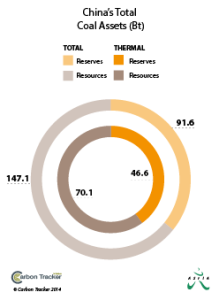

- What is the scale of thermal coal reserves, potential reserves and power generation infrastructure at risk of becoming stranded in this scenario?

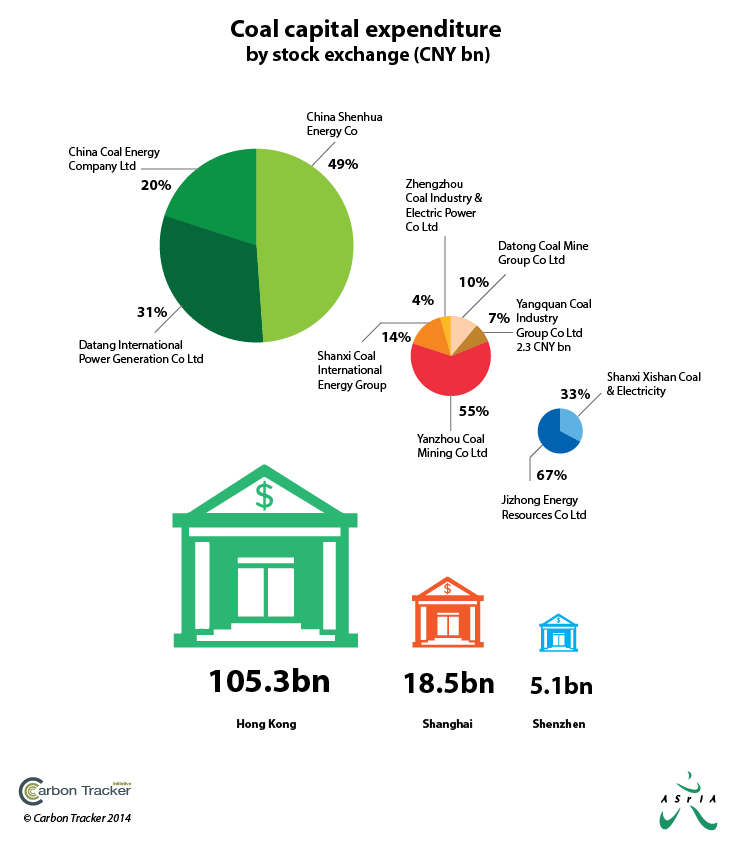

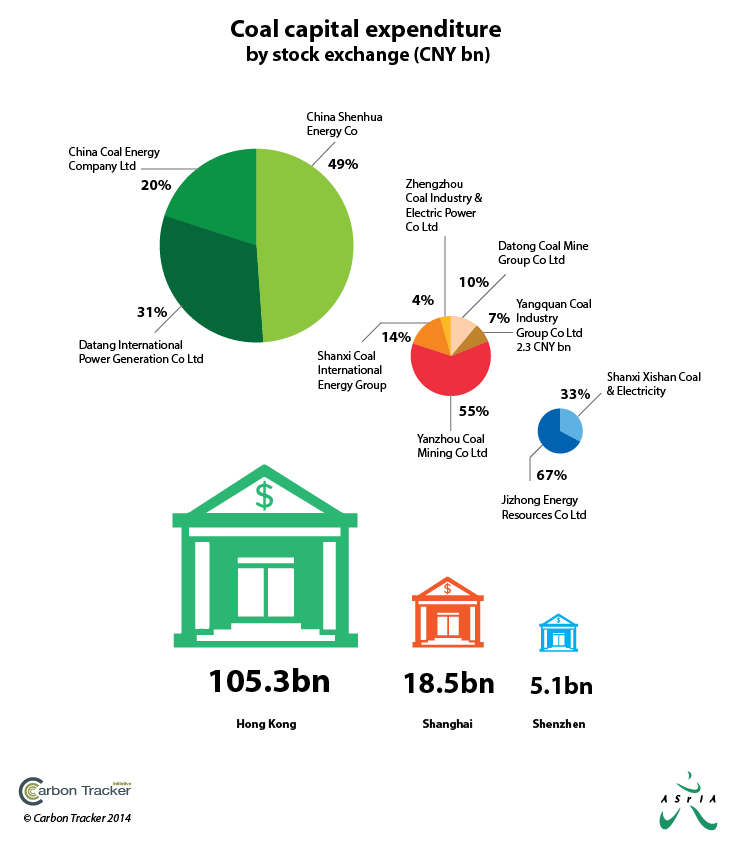

- How much capital expenditure is being committed by China’s coal sector to add to potentially strandable coal assets?

- How does this translate to investor exposure to this risk through China’s stock exchanges?

- Who is most exposed to this risk?

- What implications does this have for the international thermal coal market?

- What actions can be taken by investors and other stakeholders to minimise their exposure to potential stranded assets and, instead, take advantage of China’s transition to a more diverse power generation sector?

Quotes

Anthony Hobley, Carbon Tracker Chief Executive Officer: "China’s ‘Great Coal Cap’ could feasibly peak China’s thermal coal demand in the near-term, presenting a significant risk of asset stranding for those investing on a business as usual future. Questions need to be asked whether committing billions of capital to increase thermal coal supply in a shrinking market is a wise use of capital"

Jessica Robinson, ASrIA’s Chief Executive Officer: "China is responding to its environmental challenges in part by diversifying its power generation away from burning thermal coal – investors need to dispel any belief that Chinese coal demand is insatiable and integrate this transition into their decision-making by stress-testing the relative risks of different future demand scenarios"

Luke Sussams, Carbon Tracker’s Senior Researcher and Lead Author: "Investors in Australian and Indonesian exporters of coal, in particular, must factor much lower Chinese demand into their demand and price forecasts. If China becomes a zero imports market, which is possible, there is a noticeable lack of any viable alternative growth market for seaborne traded coal. Where will Australia’s US$50 billion of thermal coal go instead"

Andrew Sheng, Fung Global Institute’s Distinguished Fellow: "There is significant potential value-at-risk associated with a failure to recognize the impact of early peaking demand (for fossil fuel) within the sector. This has serious risk implications for investors, energy companies and policy-makers alike – especially as China’s power sector transitions to a cleaner future and the world becomes serious about climate change."