Exchanges carrying 3 times more carbon reserves than can be burned under Paris

Carbon Bubble

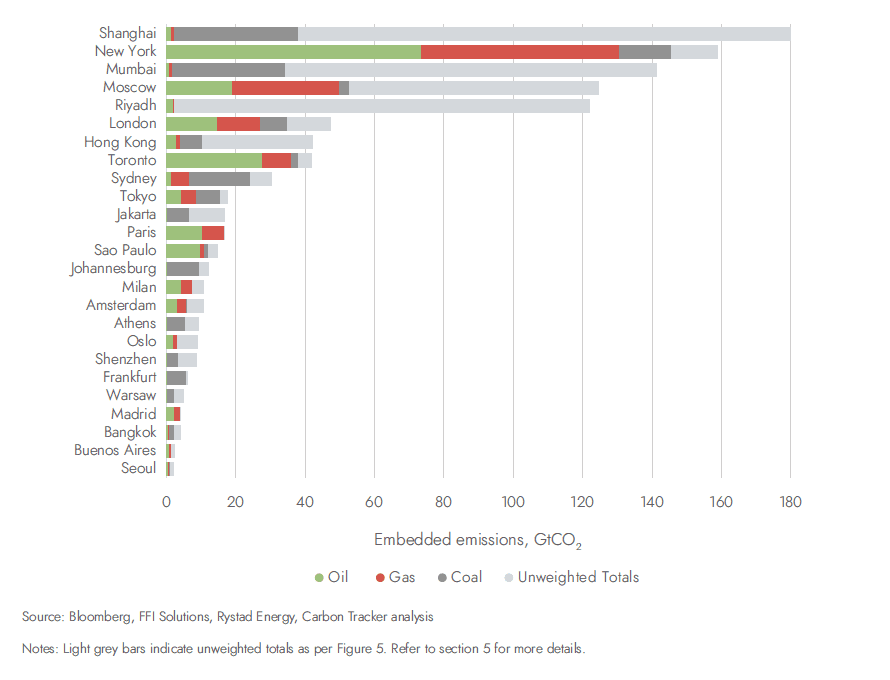

Unburnable Carbon: Ten Years On finds that the majority of embedded emissions are listed on the stock exchanges of China, USA, India, Russia and Saudi Arabia where, with the exception of the USA, emissions are dominated by the partial listings of state-owned companies.

Figure 1: Emissions embedded (GtCO2) in the reserves of listed and partially-listed companies, by financial centre of primary listing, free-float weighted.

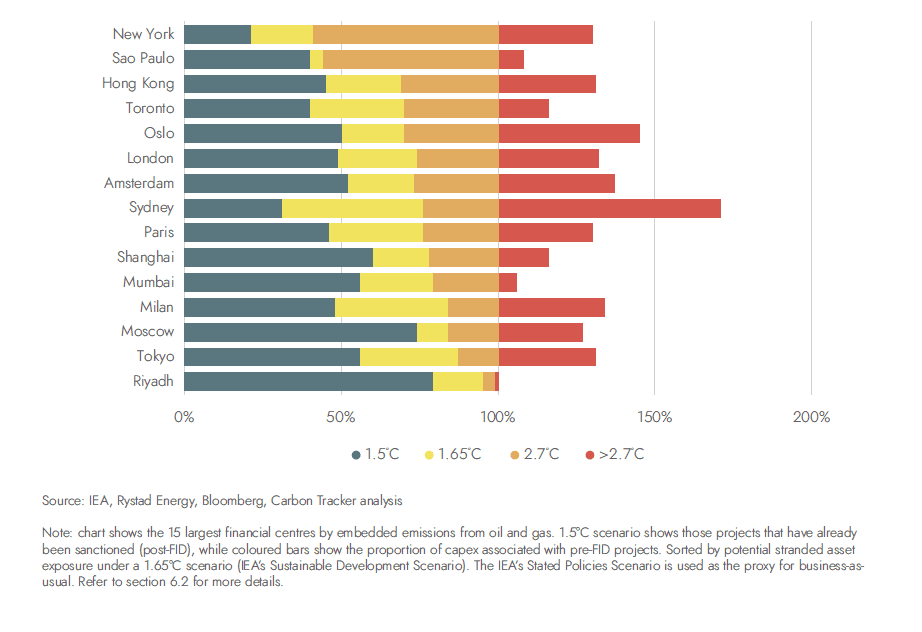

The report quantifies the stranded asset risk exposure for the oil and gas assets and finds over $1 trillion of oil & gas assets risk becoming stranded, and the majority, some $600bn, is held by listed companies. In absolute terms, this stranded asset risk is concentrated in the financial centres of New York, Moscow, London, and Toronto.

Figure 2: Stranded asset exposure by financial centre shown as upstream oil & gas capex by financial centre, 2021-2030, as % of business-as-usual capex (2.7°C).

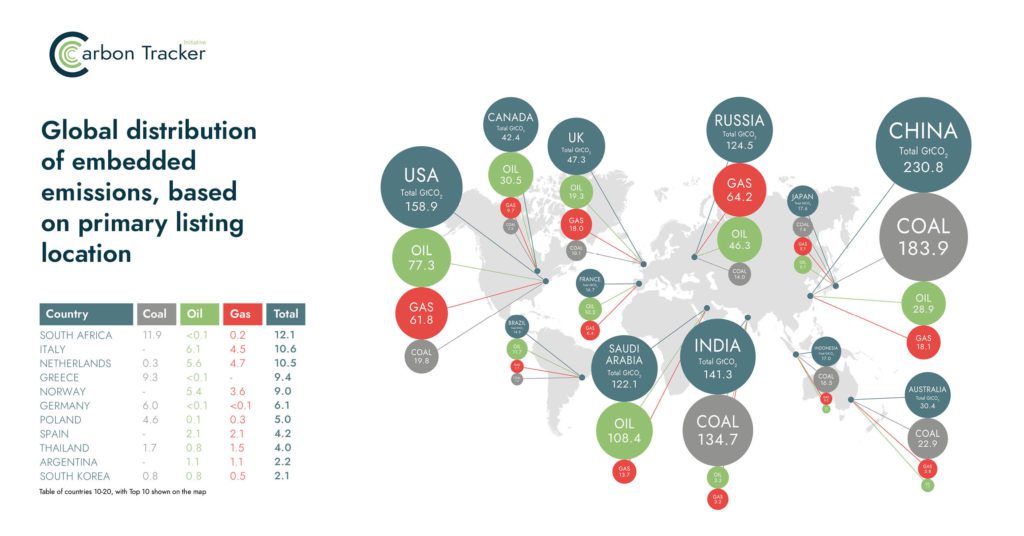

Figure 3: Global distribution of embedded emissions, based on primary listing location

Figure 3: Global distribution of embedded emissions, based on primary listing location

Author of the report, Oil & Gas Analyst at Carbon Tracker, Thom Allen said: “If governments are really serious about climate change they must ensure that the activities of stock exchanges and the financial centres around them are consistent with national climate goals and net zero commitments or we will lose any chance of meeting the Paris target. This is especially important now as fossil fuel prices and related company stocks soar.”

Mike Coffin, Head of Oil, Gas and Mining at Carbon Tracker and co-author, said: “Fossil fuel companies are reliant on equity and debt markets for the financing of capital-intensive projects, both to raise capital to finance new investments, but also to maintain existing production facilities and drill new wells. Financial centres facilitate, and profit from, both the primary equity raising and ongoing finance requirements for these companies, as well as secondary trading activities. As such, financial institutions that continue to enable such activities beyond climate limits, cannot themselves be viewed as Paris-aligned, and are also themselves increasingly exposed to transition risk.