U.S. shale oil and gas: Going over the hedge?

Sign up today to download

the full report

US shale production has prompted increased volatility in the oil markets, as exemplified by the 50% drop in prices during the second half of 2014. This has caused investors to ask whether the US shale industry can adapt to a new low price environment if it persists.

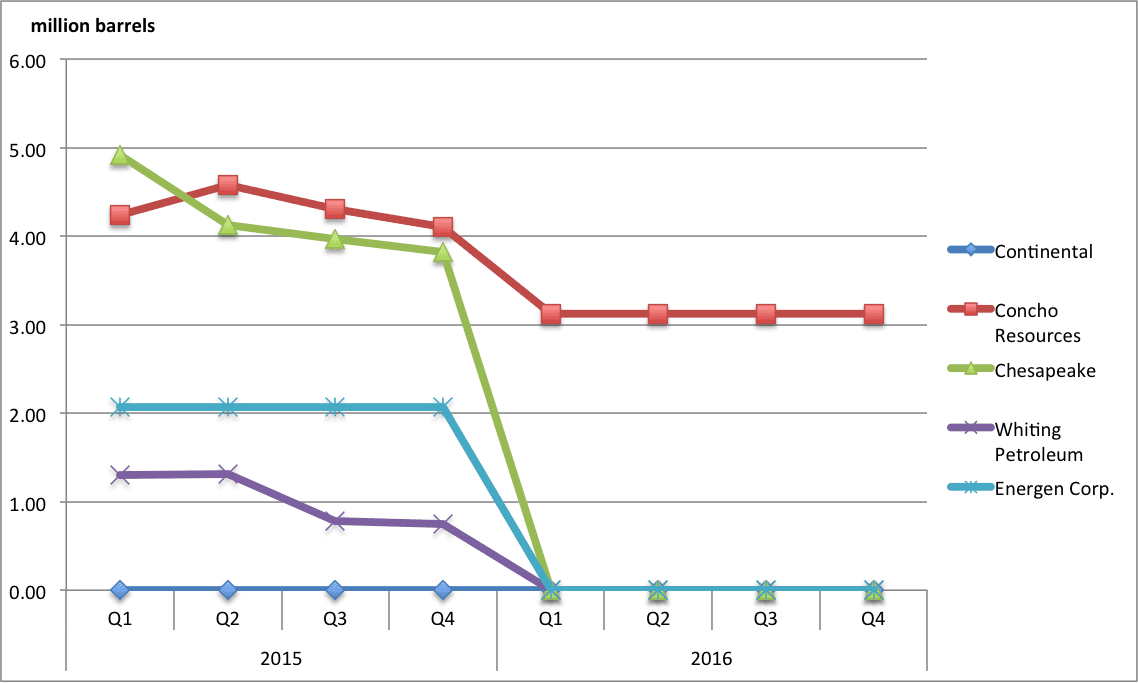

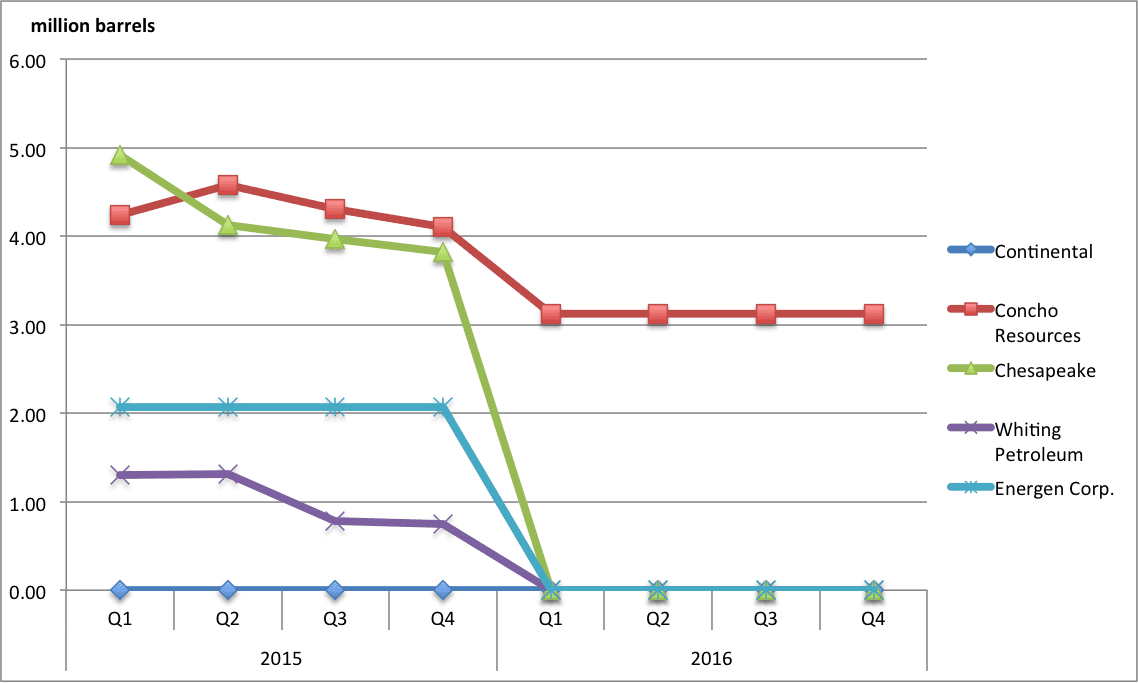

The aim of this study is to understand better the impact of a sustained reduction in commodity prices on the credit arrangements of U.S. exploration and production (E&P) companies. The study focuses on five of the largest pure-play U.S. E&P shale oil and gas companies, by market capitalisation. These companies are: Continental Resources; Concho Resources; Chesapeake; Whiting Petroleum; and Energen Corp.

These US shale operators have hedges which to some extent have given them a soft landing from the drop in oil and gas prices so far in 2015.

Crude oil hedges above $58 WTI floor, quarterly volumes, 2015-2016