Oil and gas companies still rewarding executives for expanding production, despite looming demand peak

“Low-carbon” business strategies conceal plans to expand gas

“Low-carbon” business strategies conceal plans to expand gas

Only six companies have prospectively disclosed their remuneration policies for 2023. Compared with 2022, the overall split between oil and gas production growth and other metrics has stayed largely the same, with slight variations in the share of growth metrics. One noticeable difference was the return of indirect growth incentives at TotalEnergies.

Even though incentives should be expected to support strategic objectives, of the companies which have emissions reduction remuneration metrics, the analysis finds that just five companies have incorporated metrics that directly match the wider corporate targets for emissions reductions. Of these, four cover just scope 1 or scope 1 and 2 emissions, while only Shell has a remuneration incentive that supports its scope 3 emissions reduction target in addition to operational emissions, but even then, this is only on an intensity basis. None of these targets link to the finite limits of the remaining carbon budget.

Methodology

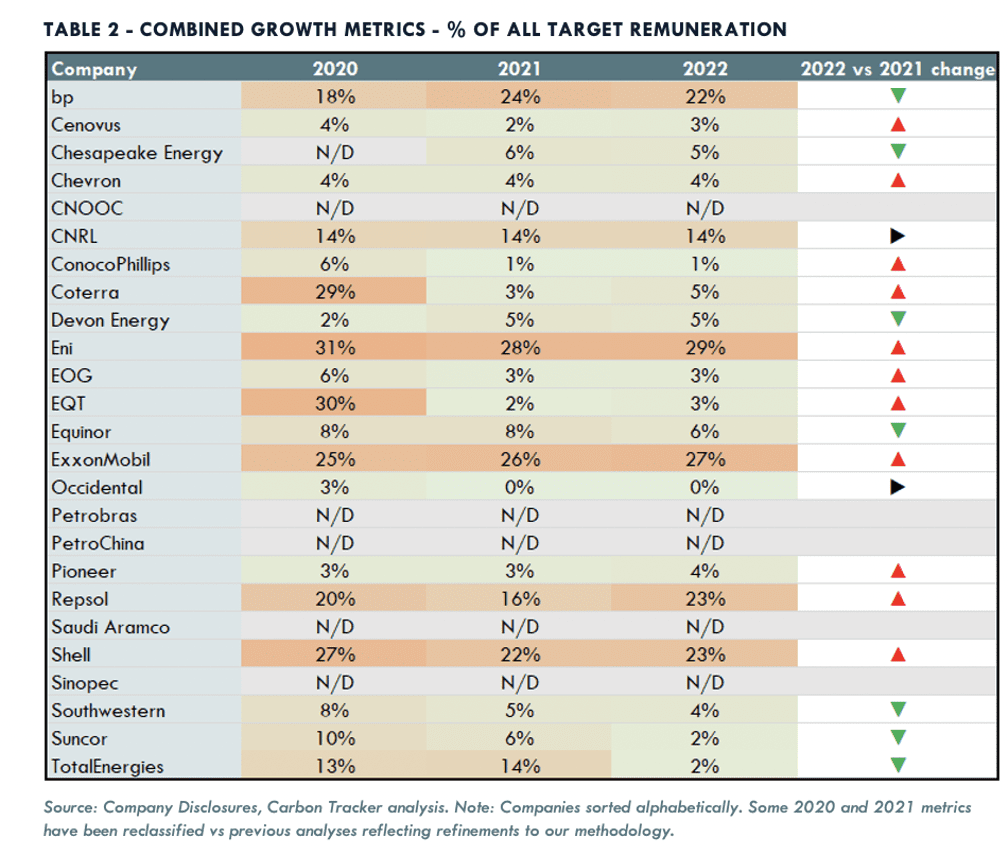

The analysis builds on the methodology first developed in Paying With Fire and updated in subsequent reports in the series, most recently in Crude Intentions that is designed to quantify the influence of incentives on executive decision-making by calculating the relative share of the different metrics used within target short- and long-term performance-related pay awards.

For the purposes of this report, metrics are grouped into one of four categories, depending on whether they incentivise: i) growing production volume directly; ii) growing production indirectly; iii) actively incentivise a strategic response to the energy transition, or; iv) focusing on value or other non-growth metrics including for example safety performance.

Once the embargo lifts the report can be downloaded here: https://carbontracker.org/reports/crude-intentions-ii-how-oil-and-gas-execs-are-still-incentivised-to-grow-production-despite-peaking-demand/

ENDS

To arrange interviews please contact:

Joel Benjamin Jbenjamin@carbontracker.org +44 7429 637423

David Mason david.mason@greenhousepr.co.uk +44 7799 072320

About Carbon Tracker

The Carbon Tracker Initiative is a not-for-profit financial think tank that seeks to promote a climate-secure global energy market by aligning capital markets with climate reality. Our research to date on the carbon bubble, unburnable carbon and stranded assets has begun a new debate on how to align the financial system with the energy transition to a low carbon future. www.carbontracker.org

Only six companies have prospectively disclosed their remuneration policies for 2023. Compared with 2022, the overall split between oil and gas production growth and other metrics has stayed largely the same, with slight variations in the share of growth metrics. One noticeable difference was the return of indirect growth incentives at TotalEnergies.

Even though incentives should be expected to support strategic objectives, of the companies which have emissions reduction remuneration metrics, the analysis finds that just five companies have incorporated metrics that directly match the wider corporate targets for emissions reductions. Of these, four cover just scope 1 or scope 1 and 2 emissions, while only Shell has a remuneration incentive that supports its scope 3 emissions reduction target in addition to operational emissions, but even then, this is only on an intensity basis. None of these targets link to the finite limits of the remaining carbon budget.

Methodology

The analysis builds on the methodology first developed in Paying With Fire and updated in subsequent reports in the series, most recently in Crude Intentions that is designed to quantify the influence of incentives on executive decision-making by calculating the relative share of the different metrics used within target short- and long-term performance-related pay awards.

For the purposes of this report, metrics are grouped into one of four categories, depending on whether they incentivise: i) growing production volume directly; ii) growing production indirectly; iii) actively incentivise a strategic response to the energy transition, or; iv) focusing on value or other non-growth metrics including for example safety performance.

Once the embargo lifts the report can be downloaded here: https://carbontracker.org/reports/crude-intentions-ii-how-oil-and-gas-execs-are-still-incentivised-to-grow-production-despite-peaking-demand/

ENDS

To arrange interviews please contact:

Joel Benjamin Jbenjamin@carbontracker.org +44 7429 637423

David Mason david.mason@greenhousepr.co.uk +44 7799 072320

About Carbon Tracker

The Carbon Tracker Initiative is a not-for-profit financial think tank that seeks to promote a climate-secure global energy market by aligning capital markets with climate reality. Our research to date on the carbon bubble, unburnable carbon and stranded assets has begun a new debate on how to align the financial system with the energy transition to a low carbon future. www.carbontracker.org